The leading innovator supplying cutting-edge integrity solutions. Together we can ensure sustainable decision-making. Our combination of advanced inspection systems and expert consultants delivers a comprehensive understanding of asset safety, lifetime, and performance.

Comprehensive Asset Integrity Management

WORLD PIPELINES | VOLUME 23 | NUMBER 9 | SEPTEMBER 2023

03. Guest comment

Thure Cannon, President, Texas Pipeline Association (TPA).

05. Editor's comment

07. Pipeline news

With news from PHMSA, TC Energy, Cheniere Energy, Wood and Vallourec.

KEYNOTE ARTICLES: AUTOMATION TECHNOLOGY

09. Maintaining control

Thony Brito, Sensia Global, UAE, discusses the value of modernising oil and gas operations with a smart pipeline strategy.

13. A new data-driven paradigm

Jochen Apel, Head of Digital Industries, Nokia, explores how converged field automation networks support the digitalisation of oil and gas.

18. Automate to produce process insights

Using advanced analytics solutions, pipeline operators can automate data aggregation and cleansing, speed up process insights, and increase shareability among teams, says Morgan Bowling, Industry Principal, Seeq Corporation, USA.

LAUNCHING AND RECEIVING PIGS

43. Successful launching and receiving Simon Bell, iNPIPE PRODUCTS, UK.

DEEPWATER PIPELINE ENGINEERING

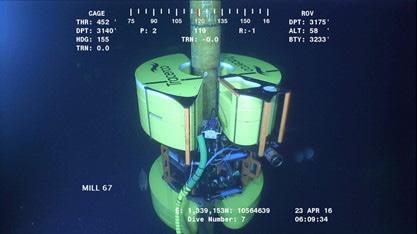

48. Real-time offshore data

Jim Bramlett, Commercial Manager, Tracerco, the Americas.

CORROSION CONTROL AND CONDITION ASSESSMENT

23. The changing market landscape

François Lachance Eng MBA, Product Manager, CREAFORM, Canada.

NORTH AMERICAN PIPELINES

28. Taking North America's temperature

Contributing Editor, Gordon Cope.

33. Expanding horizons

Lee Williams, Senior Research Analyst, Wood Mackenzie, USA.

37. Advanced analytics in North America

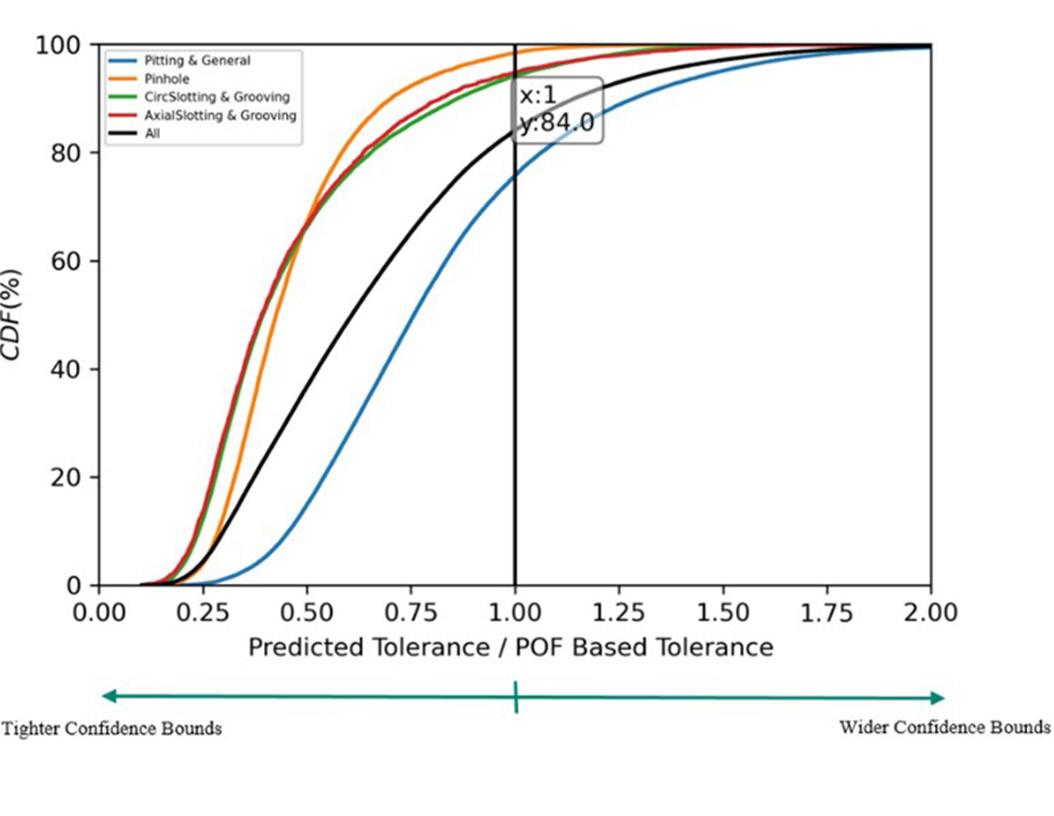

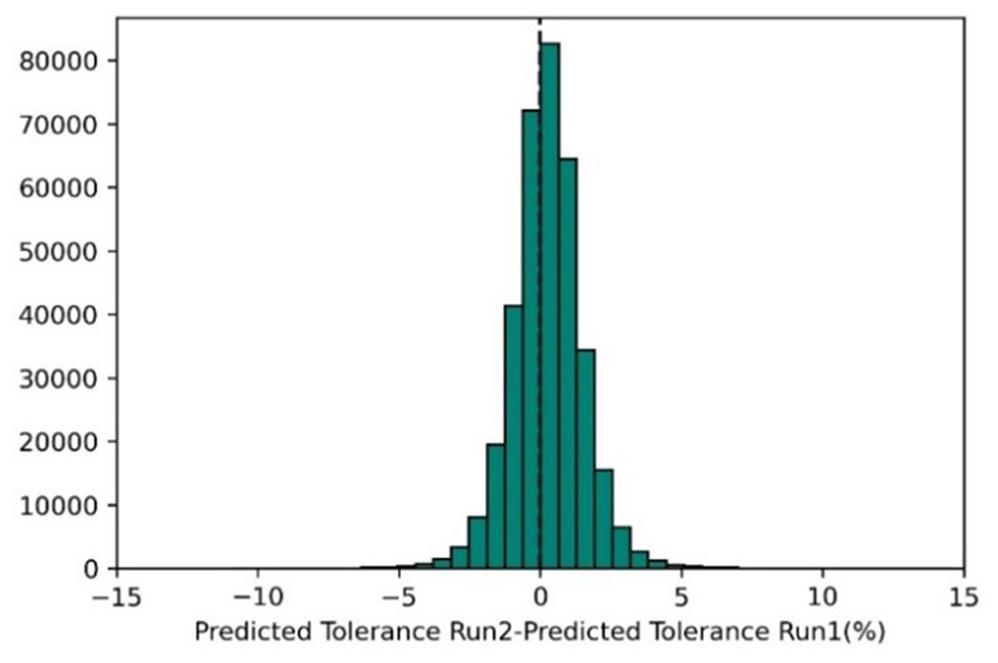

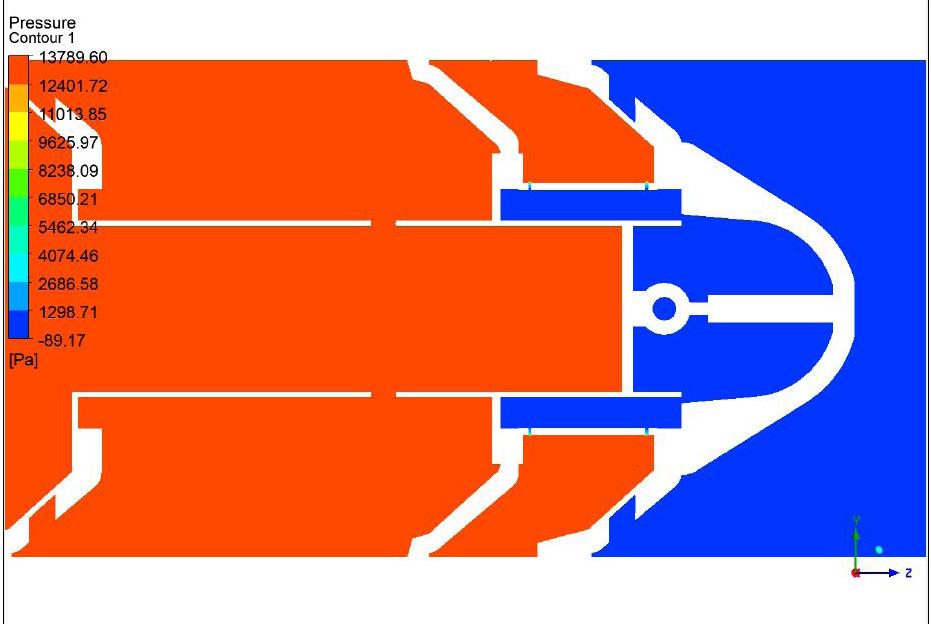

Keila Caridad, Aaron Schartner, and Vincent Tse, TC Energy, and Melissa Gurney, Scott Miller, Samaneh Sadeghi and Stuart Clouston, Baker Hughes.

HYDROGEN PIPELINES

52. Net-zero ambitions

Pipeline Industries Guild’s Net Zero Transition Panel.

CBP019982

With more than 60 years of experience, Seal For Life Industries offers the most diversified coating solutions in the market for superior infrastructure protection. Seal For Life is made up of 14 distinct brands offering products from self-healing coatings to heat-shrink sleeves, anti-corrosion tapes to liquid epoxy coatings, cathodic protection to intumescent coatings, polymer floorings to pipeline logistic solutions; all servicing multiple industries across the globe.

GUEST COMMENT T

exas is now the second most populous state in the US, gaining an average of 412 958 residents annually between 2000 and 2022 for a total population of 30 029 572. The growth has been startlingly rapid: in 2010, Texas’ population was just two-thirds that of California. By 2022, it was more than threefourths of the nation’s most populus state.

and US$377 000 in cumulative property tax revenues generated per mile of a pipeline for a typical Texas county.

In addition to fueling our homes, businesses and the economy, pipelines are the safest, most reliable, efficient and economic means of transporting large quantities of natural gas, crude and refined petroleum products.

more industry commentary,

In addition to the population growth, Texas is now home to a rapidly growing number of energy-intense businesses. In 2021, 62 corporations relocated their headquarters here to take advantage of the state’s abundant supply of natural gas, the nation’s largest and most integrated pipeline infrastructure network and the state’s adherence to competitive, free-market principles in private business dealings.

Not only does the pipeline industry transport the vital natural gas, crude oil and numerous other hydrocarbon products that are utilised by Texans and Americans every day, but the Texas midstream industry is also an economic powerhouse.

Using pipelines to transport oil and gas also helps to protect the environment, reducing the burden on our infrastructure, in part because pipelines take tanker trucks off the road. A moderate 20 in. pipeline running 50 miles through a county can displace 1650 trucks – lessening congestion, pollution, traffic accidents and highway damage.

Texas’ 437 747 miles of intrastate pipelines are also part of a growing infrastructure that transports new, lowercarbon fuels that help to reduce emissions.

SERIES 2: SUSTAINABILITY IN THE

Episode 1

Moving hydrocarbon businesses towards something greener

Episode 2

The principles and pillars of sustainability

Episode 3

Sustainability disputes: strategies for managing risk

Episode 4

Chemistry at work: sustainability in the oilfield

According to the recently released 2022 ‘Analysis of the Current and Future Economic Impact of the Texas Oil and Gas Pipeline Industry’ study, through ongoing operations and construction in 2022 alone, the industry provided more than US$60.5 billion in economic output; more than US$34 billion in additional gross state product; nearly US$3.6 billion in state and local government revenues; more than 234 000 jobs; and an estimated US$12 250 in property tax revenues generated per mile of a pipeline for a typical Texas county.

Conducted by the Center for Energy Commerce at Texas Tech University and commissioned by the Texas Pipeline Association (TPA), the study also found that the strength of the midstream industry is expected to continue. Over the next 40 years, in today’s dollars, the pipeline industry is conservatively expected to generate cumulative economic impacts of US$1.86 trillion in economic output; US$1.05 trillion in additional gross state product; US$110.34 billion in state and local government revenues; nearly 525 000 jobs;

Lower-carbon fuels, such as biofuel, hydrogen fuel and sustainable aviation fuels (SAF), are examples of renewables that may use existing pipelines that have been repurposed. Along with these fuels, both propane and natural gas are considered lower carbon when compared with traditional alternatives. In addition, the advent of CO2 pipelines has the potential to provide additional opportunities for the Texas midstream industry.

Whichever type of hydrocarbons are being transported, pipelines are the lifeblood of the energy system. Now, more than ever, it is essential that America has the needed pipeline infrastructure to provide consumers with dependable, low-cost sources of energy and industry with the raw materials used in the production of a myriad of common household and healthcare products.

Sources

Texas Joins California as State with 30-Million-Plus Population, United States Census Bureau; 30 March 2023.

YTexas Relo Tracker Report, Tracking Corporate Relocations to Texas in 2021; May 2022.

2022 Analysis of the Current and Future Economic Impact of the Texas Oil and Gas Pipeline Industry study, Texas Tech University, Center for Energy Commerce Rawls College of Business; May 2023.

Texas Pipeline System Mileage, Railroad Commission of Texas; 2022.

Thure Cannon

President, Texas Pipeline Association (TPA)

OIL AND GAS SECTOR

For

listen to the Palladian Energy Podcast

Thure Cannon

President, Texas Pipeline Association (TPA)

OIL AND GAS SECTOR

For

listen to the Palladian Energy Podcast

TRI-TOP FOR LNG APPLICATIONS

EDITOR’S COMMENT

CONTACT INFORMATION

MANAGING EDITOR

James Little james.little@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr daniel.farr@palladianpublications.com

PRODUCTION MANAGER

Calli Fabian calli.fabian@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999

Website: www.worldpipelines.com

Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada:

World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Ave, Folcroft PA 19032

PHMSA held a virtual press briefing towards at the beginning of August, to announce that it is launching Social Equity Mapping Tools to visualise pipeline accidents and incidents across the US. The endeavour seeks to promote data transparency, by making pipeline incident data easier to access and understand for the public. The Social Equity Mapping Tools provide a state-by-state analysis of reportable pipeline incidents and accidents, where users can view the cause of pipeline failures, the operator of that line, and the communities affected by the incident. These tools are part of DOT’s Justice40 Initiative to confront and address underinvestment in disadvantaged communities. They aim to make it easier for users to learn more about pipeline safety incidents affecting their communities.

The thinking behind this initiative is that visibility of pipeline incidents is key to highlighting the historical disparities and systemic issues that have led to underinvestment in certain communities. This is particularly relevant in those comprising marginalised and vulnerable populations. The DOT’s efforts to engage with communities via these new tools is encouraging: pipeline incidents can erode trust between communities and the companies or regulatory agencies responsible for pipeline operations. Lack of transparency and inadequate communication during, and after, incidents can lead to frustration and disillusionment. Pipeline incidents can have far-reaching consequences on the well-being, safety, and livelihoods of communities. These impacts underscore the importance of prioritising pipeline safety, implementing preventive measures, and supporting affected communities in their recovery efforts.

In our keynote section this month, we evaluate automation tools and technology for the pipeline industry, focusing on technologies and tools for making pipeline operations safer and more efficient.

Sensia Global introduces digital solutions to help pipeline operators keep product flowing safely, and to convert operational data into information and analytics. The article describes several case studies where pipeline operators needed to optimise and upgrade their systems, and were able to utilise modern smart operations to do so.

Nokia tackles the issue of bridging legacy and future automation applications, explaining that “many of today’s oil and gas operations rely on legacy network technologies such as serial interfaces used in SCADA and other industrial systems for operational controls and in-plant communications. Operations can’t afford to add another overlay network to what is already a burdensome mix of old and new network technologies.” Read the article at p.13 to find out how converged communications and field automation networks (FAN) can help.

Seeq recommends advanced analytics solutions for improved communication and sharing within pipeline teams. Everyone wants insight into their pipeline assets and data scientists spend a lot of time preparing data for analysis; Seeq describes how automated data conditioning and reporting can save time in getting valuable, actionable insights.

This month’s issue also includes a special section on North American pipelines, which includes an overview of the North American energy market (p.28); analysis of the changing midstream investment landscape (p.33); and a case study from Baker Hughes about its work with TC Energy, which embarked on a data analytics project to better define inspection tolerances, for increased measurement accuracy (p.37).

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.comThe experts you can trust

CRC Evans’ market-leading welding, inspection and coating services, technologies and high-performance equipment ensures efficient, on-time delivery of your global onshore and offshore energy projects.

WORLD NEWS

USDOT awards US64.4 million in pipeline safety grants

The US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) is awarding US$64.4 million in grants to support state-pipeline and underground natural gas storage (UNGS) safety operations.

These grants provide states with resources to inspect pipelines and UNGS facilities, ensuring they are complying with federal and state regulations.

“State pipeline inspectors oversee more than 80% of our nation’s 3.4 million miles pipeline system, and we want to ensure they have the resources they need to carry out their vital work,” said US Transportation Secretary Pete Buttigieg. “These grants will be another important tool for ensuring America’s pipelines are the safest and most reliable in the world.”

PHMSA will distribute US$60.5 million in Pipeline Safety State Base Grants and US$3.9 million in UNGS Grants to support state inspection and enforcement efforts, personnel reimbursement, equipment, and essential activities costs to participating states.

“These grants are critical to help states with the funding they need to carry out inspections and enforce pipeline safety regulations that keep our nation’s pipeline network as safe as possible,” said PHMSA Deputy Administrator Tristan Brown. “These grants ensure our state partners can continue to play an integral role in getting to our goal of zero safety and environmental incidents.”

48 states, the District of Columbia, and Puerto Rico participate in the Pipeline Safety State Base Grant programme, and 14 states participate in the UNGS programme.

Iraq considers rebuilding pipeline through Syria

OPEC producer Iraq is considering reconstructing an old pipeline through neighbouring Syria to export crude from a Mediterranean port to Europe and other countries, an Iraqi official was reported saying on 18 July.

The pipeline, which was commissioned in 1952, links the central Iraqi Kirkuk oilfields with the Northwestern Syrian port of Baniyas and was operational for many years before it was badly damaged during the 2003 US invasion of Iraq.

“Iraq is considering reviving the oil export pipeline through

Cheniere Energy eyes new gas pipeline

Cheniere Energy Inc, the largest US LNG exporter, says it may build a new pipeline to link its Louisiana expansion project to other pipelines in major shale-gas producing regions as it seeks to diversify its risk.

Cheniere’s Sabine Pass facility has been expanding since its production began in 2016 but needs additional natural gas beyond current supplies to reach its planned ‘Stage 5’ capacity, top company officials said.

“We will likely build a pipeline to where we can access other pipelines. That will get us Haynesville (shale gas), any additional Marcellus (gas) that will come down, mid-continent, Permian as well as Eagleford as it continues to be developed,” Corey Grindal, Cheniere’s Chief Operating Officer, told journalists recently.

Cheniere previously retooled some of its pipeline infrastructure to send gas to its Sabine Pass facility in Louisiana, but those pipelines now shoulder additional demand and are unavailable, Grindal said.

The exporter already spends US$800 million a year in pipeline transit fees to transport 7.5 billion ft3/d of natural gas from 26 different pipelines to its LNG plants in Texas and Louisiana, CEO Jack Fusco also said in the interview with reporters at an LNG conference in Vancouver. He gave no detail about the new pipeline’s cost or size.

The new project is being designed to produce up to 20 million tpy of LNG but has not yet been funded, Cheniere said on its website. Proposed LNG and gas pipeline projects in the Gulf Coast region have not faced the same environmental push back as elsewhere and should get approved, said Alex Gafford, a Capital Markets Analyst at East Daley Analytics.

Baniyas Port,” Iraqi government spokesman, Bassim Al-Awadi told the official Iraqi news agency. “Iraq is searching for new oil export outlets […] we believe that Iraq is now ready to discuss with Syria the reconstruction of Kirkuk-Baniyas pipeline,” he added.

In 2007, Iraq and Syria agreed to rebuild the pipeline but a contract awarded to Stroytransgas, a subsidiary of the Russian Gasprom group, was nullified in 2009 due to high costs and other reasons.

Wood delivers 2000 miles of low carbon pipeline projects in North America

Wood is delivering concept and front-end engineering and design (FEED) studies for nearly 2000 miles of onshore low carbon pipelines in North America. Katie Zimmerman, Decarbonisation Director of the Americas at Wood, said: “Following the roll out of key government policies and incentives in both the US and Canada, we’re seeing a significant increase in the number of proposed hydrogen and carbon capture and storage projects. In order to meet market demands, the construction of new energy infrastructure projects and the ability to repurpose existing infrastructure will play a critical role

in supporting the energy transition.”

In addition to completing carbon capture and transportation studies for over 150 facilities globally, Wood is expanding the USA’s network of hydrogen pipelines by a third and will add nearly 1000 miles to carbon capture pipeline networks across North America. Furthermore, at a moment in time when extreme heat has made the delivery of electricity to homes critical, Wood is continuing to grow critical networks for natural gas – working across the region to secure a low carbon energy system for North America.

CONTRACT NEWS

TC Energy sells pipeline stake to GIP for CAN$5.2 billion

Vallourec wins two major offshore line pipe contracts

5 - 8 September 2023

Gastech 2023

Singapore www.gastechevent.com

5 - 8 September 2023

SPE Offshore Europe 2023 Aberdeen, Scotland www.offshore-europe.co.uk

11 - 15 September 2023

IPLOCA 2023 convention Vancouver, Canada www.iploca.com/events/annualconvention/2023-convention

17 - 21 September 2023

World Petroleum Congress 2023 Calgary, Canada www.24wpc.com

21 - 22 September 2023

Subsea Pipeline Technology Congress (SPT 2023) London, UK www.sptcongress.com

2 - 5 October 2023

ADIPEC 2023

Abu Dhabi, UAE www.adipec.com

24 - 26 October 2023

OMC 2023

Ravenna, Italy www.omc.it/en

14 - 15 November 2023

Gas, LNG & The Future of Energy Conference

London, UK

www.woodmac.com/events/gas-lng-futureenergy

Canadian pipeline giant TC Energy Corporation is selling a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission for CAN$5.2 billion (US$3.9 billion) to Global Infrastructure Partners (GIP).

TC Energy said in a statement on 24 July that it will continue to operate the systems, but it will jointly invest in annual maintenance, modernisation and growth with GIP.

The infrastructure company’s 40% share of capital expenditures is expected to average more than CAN $1.3 billion/yr for the next three years.

Calgary-based TC Energy, which also owns the Keystone oil pipeline, has said it planned to sell assets this year to cut debt and fund other projects such as the Coastal Gas-Link pipeline in British Columbia, which is facing cost overruns.

The Columbia Gas and Columbia Gulf pipelines span more than 15 000 miles.

Forum Energy Technologies appoints subsea partner in Brazil

Forum Energy Technologies (FET) has appointed UnderOcean Servicos Maritimos (UnderOcean) to represent its Subsea operations in Brazil.

The partnership will see UnderOcean provide business development and engineering support on behalf of FET’s Subsea Technologies product line in Brazil. Headquartered in Macaé, Rio de Janeiro, UnderOcean will deliver service, repair, calibration, upgrades, and modifications for FET’s remotely operated vehicles (ROVs), associated tooling and Dynacon Launch & Recovery Systems.

With more than 20 years’ experience in the offshore industry, UnderOcean provides skilled personnel to the global offshore and subsea construction industry. It also supplies simulator training, scenario development and has a key focus on delivering highly competent, skilled technicians who operate with the highest levels of safety and respect for the environment.

Kevin Taylor, Vice President - Operations, Subsea Technologies said: “This agreement will ensure that our clients in Brazil receive the same streamlined and reliable support they are accustomed to from our teams around the globe.”

Vallourec has won two major orders to supply line pipes for phases 6 and 8 of the Buzios oilfield development, operated by Petrobras. These orders are in addition to the contract previously won for phase 7, representing a total of 48 000 t of line pipe.

Located off the Brazilian coast in the pre-salt Campos Basin, Buzios is one of the world’s largest deepwater fields. It accounts for 25% of the Brazilian oil company’s production alone.

The equipment ordered from Vallourec for phases 6, 7 and 8 of the project includes 346 km of subsea line pipe for the risers and flowlines in the Subsea Umbilicals Risers and Flowlines (SURF) package.

ON OUR WEBSITE

• KazTransOil increases oil transportation

• Kinder Morgan 2Q23 revenue misses on lower prices

• RPS to support new MetOcean project in West Africa

• GlobalData: Low-carbon hydrogen critical for netzero

• Valmet acquires Process Gas Chromatography business

• Pakistan imports Russian gas

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

iles of new pipelines are built yearly to help meet rising demands for transporting oil, gas, and petroleum products. Whether your pipelines are remote and unmanned or pass near city centres, the ability to keep product safely flowing 24/7 is critical. Pipelines continue to offer the best cost advantages for shipping oil and gas. As a result, recent industry estimates say that, within the next 20 years, there will be 264 000 miles of new pipeline and 12 million additional horsepower in compression and pumping in the US. Oil and gas producers around the world face similar challenges, and this change to the industry’s worldwide infrastructure means more demand for existing infrastructure.

Digital solutions are available to help pipeline operators meet these challenges

from a wide range of motor control, process control, and information solutions and services. These digital technologies help to provide excellent equipment reliability, production efficiency, and lifecycle management. Taking advantage of digital technologies can make pipelines smarter and optimise operations. The next step is collecting and analysing data with the appropriate technology deployed. Data on its own has little value; it is by contextualising this data and providing valuable insights that improvements can be achieved.

Rockwell Automation offers process control solutions integrated with motor control, providing easier operational data access. FactoryTalk InnovationSuite, powered by PTC, helps convert data into information and analytics backed up by

ThonyBrito, Sensia Global, UAE, discusses the value of modernising oil and gas operations with a smart pipeline strategy.

remote support and monitoring to help reduce unplanned downtime.

Greater productivity and profitability

By combining these solutions, operators are moving towards a smart pipeline, and all the benefits can be considerable.

According to a Deloitte report – ‘Bring the Digital Revolution to Midstream Oil & Gas’ – a data-driven approach can reduce annual downtime by 70%, and bring unplanned costs to 22% of the total, compared to 50%.

A modern, secure, information-enabled infrastructure connects intelligent assets and shares information across your pipeline. A smart pipeline comprises seven elements: multidisciplinary control, AC drives and MCCs, condition monitoring, turbo machine control, secure network infrastructure, mobile and open information platform, and operations intelligence software.

Integrating the pipeline monitoring, safety, and power control systems into one pipeline-wide infrastructure viewed through a control centre that becomes the hub of pipeline operations, increases visibility and delivers valuable realtime insights to operators. The workforce requires accurate, real-time, easy-to-understand data to perform their jobs effectively. The Rockwell Automation solution provides seamless connectivity to multiple systems across the pipeline, including pumping stations or compressor stations, metering stations, tank farms, terminals, and block valves.

With the FactoryTalk portfolio of software applications, a consistent visualisation platform can be deployed at all levels across the pipeline through compact operator panels and local HMIs at the stations and in the control room.

By combining leading-edge motor control and protecting devices with advanced networking and diagnostic technologies of the Rockwell Automation Integrated Architecture system, the performance and reliability of the control system can be optimised. In pipeline transportation, system operators must have access to information about motor status and health.

Intelligent Motor Control technologies monitor numerous aspects of motor performance, and operational data is fed back into the system via Ethernet/IP.

Condition monitoring products such as real-time protection modules, sensors, portable instruments, and surveillance software help pipeline operations run efficiently by detecting potential equipment failures, and these solutions are specifically designed for harsh environments. The Rockwell Automation XM Series of intelligent I/O modules performs real-time processing of critical parameters used to assess the current health and predict the future health of your pipeline equipment and machines. The XM modules can be deployed in standalone systems or with existing automation and control systems.

As equipment becomes more interconnected, it is crucial to have access to more data than ever before. Yet, it can be challenging to find efficient ways to extract the right information that will help keep the pipeline running at peak efficiency. By utilising remote monitoring and analytics services that offer a simple and secure approach to monitoring equipment and collecting valuable performance analytics,

operators can better understand how well the equipment performs and receive alerts when performance falls outside the predefined parameters. The remote monitoring and analytics services collect, organise, and contextualise real-time data across the production assets. This actionable information provides deep insights through powerful visualisation, analytic and dashboarding tools across various devices.

Improving performance

Implementing a control system upgrade in a legacy pipeline compression station in North America resulted in a lower cost of ownership, simplified HMI configuration, improved operability, and reduced downtime.

Electricity and natural gas delivery company CenterPoint Energy – Mississippi River Transmission (CNP-MRT) owns and operates 8200 miles of transmission pipeline that carries 1.6 trillion ft3 of gas throughout a nine-state, mid-continent region. Transmission-business success depends on meeting complex, capital-intensive, and data-critical infrastructure challenges, and reliably moving large volumes of natural gas over long distances to 22 gas-fired power plants.

Competing for utility customers against other transmission companies and alternate forms of energy requires CNP-MRT to leverage technology that minimises operating, maintenance, and downtime costs. This allows them to achieve price and service levels that win and retain utility customers. Transmission profitability is complicated further because the throughputdependent segment also must accommodate variables, such as demand-reducing mild weather, fluctuating gas prices, and regulatory-compliance overhead.

Efficiently, reliably, and intelligently controlling, automating, and monitoring the performance of reciprocating engine compressors represents one of the most significant challenges in moving the highest quantity of natural gas at the lowest cost. The school bus-sized engines maintain a pressurised flow (up to 1500 psi) to reduce gas volume up to 600 times and propel it through a pipeline.

Each compression station is located at 40 - 100 mile intervals along a pipeline route, and each utilises 2 - 10 compressors in the 2000 hp range. Ageing systems typical in the energy-delivery space are built to last; even equipment that went online in the 1960s can have another 20 years of life. At the same time, decades-old machines are not as efficient as current technology, and as a result, control systems tend to underperform current standards.

Upgrading control systems across the sizeable Midwest compressor fleet represents an enormous capital undertaking, particularly under a traditional outsourcing model that contracts control design and implementation to multiple engineering firms and system integrators. Over time, that approach created a mix of control products and solutions at CNP-MRT – often based on black-box proprietary logic.

The CNP-MRT control and automation group saw the company’s Horseshoe Lake compressor station as a test case for designing and deploying an internally executed station upgrade. The four-compressor facility in Grant City, Illinois is on the CNP-MRT pipeline that transports the bulk of natural gas moving from state to state in the Missouri, Arkansas, and

PROTECTIVE OUTERWRAPS

HEAT SHRINKABLE SLEEVES

SOIL-TO-AIR INTERFACE

INTERNAL

DENSO™ are leaders in corrosion prevention and sealing technology. With 140 years’ service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide.

United Kingdom, UAE & India

USA & Canada

Australia & New Zealand

Republic of South Africa

FOR CORROSION PREVENTION

www.denso.net

www.densona.com

www.densoaustralia.com.au

www.denso.co.za

LIQUID EPOXY COATINGS PETROLATUM TAPE WRAP SYSTEMS BUTYL TAPE WRAP SYSTEMS PIPE LININGS BITUMEN TAPE WRAP SYSTEMSIllinois region. The seven-year-old station was relatively new, but at the time of construction, the original, economicallyminded systems integrator opted for proprietary architecture, and PLCs were already nearing the end of their life span.

For example, adding another step in an engine start up sequence required a control vendor to reprogram it at an additional cost for each improvement. Troubleshooting a problem or obstacle, particularly in the middle of the night or on the weekend, opens compressor operations to downtime risk.

CNP-MRT used the Horseshoe Lake station to create and prove a potential model to cost-efficiently develop, manage and implement a major control upgrade relying heavily on in-house resources. CNP-MRT selected a PlantPAx distributed control system from Rockwell Automation that integrates control and information, using an open architecture to combine the capabilities of a DCS system with pervasive access to engine operation data. Vastly improved asset visibility and production information give station operators the data to respond faster to maintenance, operation, and flow-control issues.

The upgrade enables station operators to manage speed and load control more easily, and the control system determines which compressor units should start based on engine hours and the number of engines the system controls. The visualisation capabilities within the PlantPAx system provide a window on compression by incorporating performance metrics and the situational display of production information at engine, station, and pipeline system levels. Accurate reporting of real-time engine events, analysis tools, and management dashboards deliver contextual, localised, rolebased information for better decision-making.

Automatic control system for oil and gas terminal

Supervisors of the EP Petroecuador Balao terminal decided to carry out a complete renewal and updating project of the pumping station operations, which included developing an automatic control system for managing the maritime terminal. At the Balao maritime terminal, they oversee the receiving of finished products and communication with the tankers that perform operations for loading and unloading derived products from hydrocarbons to and from the refinery in Esmeraldas.

The office of the supervisors of the Balao terminal serves an average of 450 ships/yr, both international and coastal. The supervisor of the Balao Terminal carried out a technical inspection of the terminal and decided to optimise its facilities, which included the total renovation of this station; the project led to the development of an automatic control system for managing the maritime terminal.

The terminal had pumping units that were 35 years or older that had received scant investment and maintenance during that time. The reliability of these units was very low, which generated a series of operational problems on an ongoing basis. Rockwell Automation’s automation and software division provided automatic control systems, process control networks, information Ethernet IP, and software for historicising variable management instruments and condition monitoring pumping units.

Other divisions of Rockwell Automation were also involved in the project. The power systems unit was responsible for providing the variable frequency medium voltage drives that were used to drive pumping units. The service unit was responsible for managing and overseeing all the sub-contractor work, and testing and commissioning MV drives. Finally, the systems and solutions unit completed the management and full integration of the project.

The implemented control system, the PlantPAx modern distributed control system, includes not only the monitoring of process variables or the management of control valves for appropriate products that will be pumped, but also integrates with the variations of frequency PowerFlex 7000 AC drives. This allows optimised control and management of the pumping system and the ability to control pressure with high precision, temperature, and flow of fuel, in addition to measuring the vibration and temperature in the bearings of pumps and key points to protect and increase the reliability of the pumping units.

With the implementation of this system, the port terminal managed to triple its capability of loading and unloading ships. This shows the solution provides a great benefit by reducing the downtime of a freighter, which means significant cost savings for the company. In addition, it was possible to optimise delivery to the Esmeraldas refinery for the processing and distribution of fuel.

The operation is also now very safe and reliable so that the pumps can be used at full capacity. With some control algorithms implemented by Rockwell Automation, they can determine the ideal time to slow down, thus reducing the pump flow. As a result, operations can also prioritise the quality of fuel transferred with the lowest possible risk. Before, all processes were performed manually, such as handling the different product lines and pumping units; now, they are conducted automatically, which allows, among other things, the reduction of hazardous mixtures of products.

Changing how the sector operates

Modern smart operations driven by the Industrial Internet of Things (IIoT) unite people, processes, and technology in an integrated network architecture. Modern systems help converge business-level IT systems with the station – and terminal-level operations technology (OT) systems to enable seamless connectivity across an entire oil and gas operation – from the pipeline to the oilfield and processing plant to the enterprise. Additionally, smart operations use the latest integrated control and information solutions to collect operational data and deliver it to workers as actionable intelligence.

Modern systems are changing the oil and gas industry as we know it. In particular, the IIoT enables the connection of smart devices and systems to offer the potential for pipeline operators seeking to optimise their operations and address their biggest challenges. Rockwell Automation and our PartnerNetwork members bring expertise in new pipeline construction and experience with existing system upgrades.

he oil and gas industry is embracing digital automation as a way to improve productivity, safety and sustainability across all their operational sectors –upstream, midstream and downstream. The global demand for petroleum and natural gas requires companies to venture further and deeper into new territories; at times, operating in remote and inclement areas under hazardous conditions to reach new reserves. To meet these challenges profitably, especially given the volatile dynamics of today’s energy markets, they are embracing Industry 4.0 advancements like automation, predictive analytics, digital twins and artificial intelligence/machine learning (AI/ML). As part of this, converged communications and field automation networks (FAN) are proving foundational to this transformation. The recent advent of industrial-grade private wireless networks such as 4G/LTE and 5G, as well as a proliferation of industrial IoT sensors and intelligent devices, is a game changer for remote operations across the resource extraction industry.

Wireless IoT and intelligent devices change the economics of digitalising operations. By generating more operational and environmental data, operators can become data-driven and introduce automation even in the most remote locations. Technologies like digital twins, AI and ML can leverage this data for powerful automation capabilities, as well as predictive analytics for everything from improved maintenance and safety to environmental protection.

Bridging legacy and future applications

Despite the promise of these new technologies, many of today’s oil and gas operations rely on legacy network technologies such as serial interfaces used in SCADA and other industrial systems for operational controls and in-plant communications. Operations can’t afford to add another overlay network to what is already a burdensome mix of old and new network technologies. With the explosion of new and intelligent applications, realtime data gathering is also now essential. AI and ML software

Jochen Apel, Head of Digital Industries, Nokia, explores how converged field automation networks support the digitalisation of oil and gas.

is only as good as the data it is trained on. Older purposebuilt networks serving specific use cases and applications are increasingly a barrier to realising this new data-driven paradigm. Even with new broadband wireless technologies such as Wi-Fi or LTE, the radio network sometimes still needs to be segmented so that every time a new application is deployed, in addition to configuring a new virtual local area network (VLAN) domain, a new Wi-Fi SSID or LTE Access Point Name (APN) is required. This paradigm incurs significant wireless network management overhead.

Internet protocol multi-protocol label switching (IP/MPLS) offers seamless convergence with its service aware QoS capability. By harnessing IP/MPLS multiservice capabilities, it needs only one APN at the LTE layer for the lifetime of the network. This allows oil and gas companies to build and configure the underlying LTE network only once and be ready for any legacy, new or future oil and gas applications. This seamless capability enables existing fixed networks used by operations centres to connect with remote field operations over LTE/5G.

Automation requires robust support of machine-to-machine communications. In addition, IP/MPLS VPN’s unique flexibility in multipoint Ethernet and IP services allows any-to-any direct communications over LTE/5G among all necessary automation subsystems anywhere – whether in the oilfield, along the pipeline or inside the plant – without needing to go through a central IP gateway. This capability makes it ideal for fast rollout of reliable communications to new use cases.

To support an automatic drilling system (ADS), for instance, it is necessary to connect different subsystems in real-time. This includes the top drive unit, the pipe handling equipment, and the sensors monitoring drill bit depth and penetration rate, as well as the automation controller to communicate. For this, IP/ MPLS can set up VPNs at both the IP and Ethernet layers (L3 and L2) – the latter being ideal for control applications using Profinet. It can assure strict quality of service across both the fixed and wireless networks, as well as very high reliability, which is critical to ensuring the performance of ADS.

For efficiency and seamless data exchanges, IP/MPLS provides oil and gas companies with a bridge between where they are and where they want to be – ensuring a successful digital transformation. It gracefully adapts legacy serial control data over IP, while accommodating all modern applications for control and monitoring. It also extends seamlessly over LTE or 5G wireless networks to mobile and stationary equipment and workers at the most remote locations.

An IP/MPLS converged FAN creates a seamless end-toend converged communications layer that can accommodate everything from supervisory control and data acquisition (SCADA) and push-to-talk services to 8K video, drones and industrial IoT. It empowers oil and gas companies to overcome their challenges in areas like search and prospection, drilling and extraction, situational awareness and predictive maintenance.

Search and prospection

Typically, exploration teams are forced to communicate with each other and back to the office using expensive and bandwidthlimited satellite phones. This is because the process of search and prospection is often an isolated exercise that feels nomadic, and places teams as well as their equipment in remote areas – usually without access to a communication network. As a result, the engineers in the field also have to collect, transport and deliver their data manually using laptops, hard drive disks and USBs. This means, however, that they don’t have access to some of the most powerful analytics tools to help predict the location of high potential oil and gas fields. These models are too complex to be run on a laptop and require access to cloud compute resources.

For these kinds of remote operations, a portable LTE configuration can be set up in minutes and serve hundreds of users, even in the most extreme conditions far from existing coverage. Paired with a satellite or microwave link, this solution can provide high bandwidth mobile connectivity for sensors, field workers and drones; both for collecting data, as well as providing field workers with access to remote data and remote processing capacity. Once the connection is established, the IP/MPLS

network can seamlessly connect the local team with operations and data centres feeding data from the field – processing it in the data centre and giving them near real-time analytics.

Drilling and extraction

Although mostly manually operated today, companies are pursuing a strategy of extreme autonomy for drilling and extraction. It will not only improve safety with crewless rig floors, but promises greater efficiency and performance on the rig and in the wellbore itself. Similarly, supporting automation with remote operations allows personnel to operate machinery from a distance via virtual telepresence so they can monitor the automated processes as a supplement.

As the resource extraction industry struggles in some geographies to hire qualified workers in far-flung locations for hazardous jobs, leveraging rig automation promises to offer safer jobs and more consistent performance – even with inexperienced crews who only need to focus on supporting the automated driller with maintenance, inspection and rig moves. Cloud-based ML can also be used to optimise drilling performance using, for instance, automated reaming, MSE-based ROP optimisation and automated downlinking to the rotary steerable system. Having the ability to operate equipment remotely from an offsite operations centre makes no difference to the rig operation but makes the work more attractive and enables remote expert personnel to oversee more than one rig at a time.

Additionally, robots and drones can replace the manual inspection of facilities including offshore sites, inside tanks and pipes, platform parts and complex or hazardous access points. Thousands of manual operations and processes can be transformed into a small number of automated processes, controlled remotely if the communication platform can meet the bandwidth and latency requirements.

Remote operations, however, require high bandwidth and low latency connectivity. Remote drilling platforms typically have ten or more cameras streaming high-definition video. At the same time, remote controls must be near instantaneous, requiring low latency communication links. This is where the network becomes pivotal: LTE and 5G wireless networks can provide the kind of bandwidth required to meet the latency requirements for remote control of machinery locally, using a satellite or microwave link to connect the rig with the remote operations centre.

Situational awareness and digital twins

The safety, sustainability and security of future oil and gas operations rely heavily on situational awareness. Video coverage and massive sensing can help with this, but in order to achieve 360˚ awareness, the wireless network must be able to meet the excessive bandwidth demands of video cameras across an entire coverage area spanning onshore and offshore assets in order to properly support remote drilling operations. Many of these cameras may be mounted on mobile vehicles or drones, which can also be equipped with infrared, environmental sensors and loudspeakers for warning workers and intruders away from red zones or directing personnel during extreme events.

The network must be able to manage and connect thousands of IoT sensors that enable machine health and

diagnostics, position reporting, process monitoring and control, as well as environmental monitoring. In addition, the network must also be able to support smart tools, communication devices and digital PPE for mobile workers. This data can be fed into digital twin software for a digital model of the physical environment, constructed using geological, engineering and asset information. It can be continuously updated with data from sensors, cameras, drones and location-aware mobile devices. By using virtual simulations of the work environment, operators will be able to create long-term and short-term schedules, make accurate estimates for personnel and machine efforts, and predict what the end product results will be.

Drones can also survey, map and take volumetric measurements of a site to construct a 3D digital image of it used for monitoring, inspecting and mapping wellheads, pipelines and storage tanks. Augmented and virtual reality (AR/VR) systems will use the digital twin to provide offsite and onsite staff with real-time information and scenario simulations, while AR glasses provide step-by-step instructions to service engineers.

Predictive maintenance using IoT and analytics

Maintenance and repair of vehicles and equipment poses challenges in planning the availability of replacement parts as well as scheduling maintenance teams and resources. Breakdowns and unscheduled maintenance of ageing assets can wreak havoc with operations, with rig downtime being measured in millions of dollars per day.

Predictive maintenance applications use data collected from IoT sensors to feed asset management and advanced data analytics. By recognising anomalies in the data, these applications can alert personnel to the need for inspection. Relying on calendar-based maintenance schedules from the vendor isn’t enough either, because doing that alone results in many assets failing during operations. On the other hand, conducting maintenance too often can also lead to waste by replacing or refurbishing assets that could still be viable as is. Because they generate more accurate profiles for each piece of equipment, predictive maintenance software can avoid the shortened inspection windows suggested by the manufacturers’ calendar-based schedules, secure in the knowledge that the monitoring applications will alert them to potential issues should they arise earlier than expected.

FANs key to digital transformation

As oil and gas companies face an array of constantly changing business conditions and more stringent environmental regulations, there is a pressing need to digitally transform their operations. Technologies like industrial IoT, digital twins, predictive maintenance, automation and remote control will lead the oil and gas 4.0 transformation.

Connecting remote prospection, drilling, wellheads and pipelines to data centres and operations, a robust and reliable FAN based on the convergence of IP/MPLS and industrialgrade wireless will be essential. This seamless connectivity platform will ensure that oil and gas operations can take maximum advantage of their end-to-end data to modernise their operations, improve safety and ensure profitable and sustainable operations.

Using advanced analytics solutions, pipeline operators can automate data aggregation and cleansing, speed up process insights, and increase shareability among teams, says Morgan Bowling, Industry Principal, Seeq Corporation, USA.

n the world of digital technology for process control, various systems have been used to monitor, collect, and process data in real-time for decades. These include supervisory control and data acquisition (SCADA) systems, historians, laboratory information management systems, and databases.

The seemingly endless supply of time series data can be referenced to identify situations where optimisations can improve operational efficiency and reduce upsets, providing opportunities to drive progress toward critical corporate initiatives. Yet, many organisations face challenges accessing and connecting data from these systems – which are often siloed – analysing it efficiently, and operationalising insights in an effective manner.

Addressing these and other issues, modern advanced analytics solutions are enabling pipeline operators and organisations throughout the process industries to automate data aggregation and cleansing. This helps companies decrease time to value, shift operations and maintenance from reactive to proactive and predictive, and more easily share insights with multidisciplinary teams. It also empowers teams to spend more time digging into and analysing data to identify operational issues and areas for improvement, aiding in decision-making and ultimately driving business outcomes.

Data wrangling challenges

While analytics applications have come a long way over the past decade, a staggering number of process engineers and data analysts are still stuck using spreadsheets for data aggregation and analysis, requiring inordinate hours manually prepping and cleansing information from

multiple sources. Spreadsheets are wrought with limitations, including subpar computational capability, lack of live data connectivity, prohibitively difficult shareability, and clumsy visualisation and reporting functionalities.

Void of live connections to both historical and live data sources, these subject matter experts (SMEs) are forced to manually query each individual database, extract the necessary data for analysis, then aggregate and align mismatched timestamps in a spreadsheet. When a new time period of interest is identified, the process must be repeated.

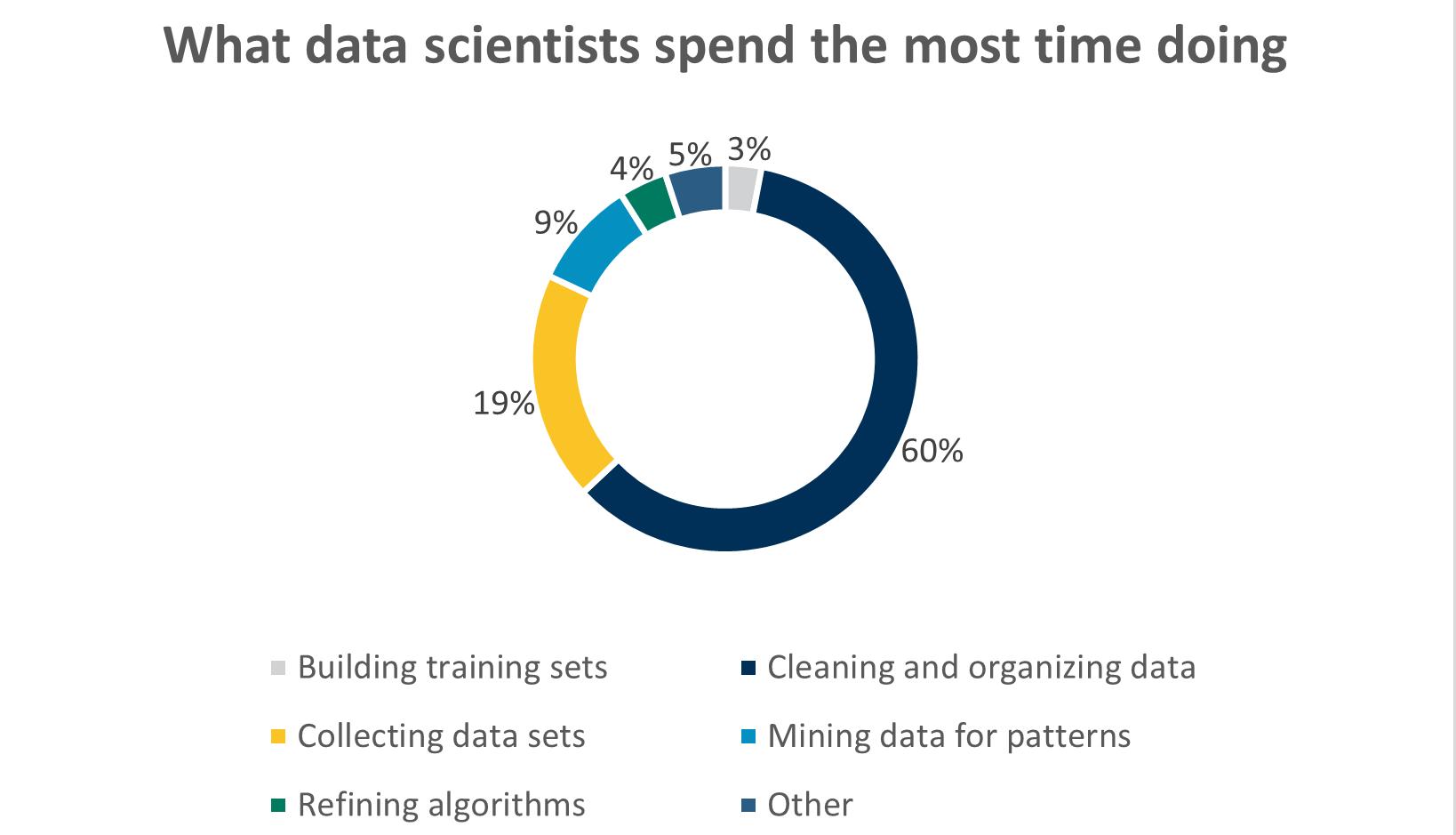

With so many hoops to jump through, it is easy to understand why nearly 80% of engineers, scientists, and analysts surveyed in a 2016 CrowdFlower study reported spending more time collecting and wrangling data into formats suitable for analysis than any other task (Figure 1).1

Using spreadsheets to analyse process data is filled with obstacles, and leaves little time for gleaning meaningful insights, preventing organisations from making sense of data in the broader business context to glean insights necessary for increasing operational efficiency and profitability.

Automated data conditioning and reporting saves valuable time

By leveraging advanced analytics solutions, organisations can move away from spreadsheets – automating data collection, conditioning, and subsequent reporting – and free up large periods of SMEs’ time, empowering them to reallocate it to optimising operations and improving plant efficiency.

Many of the world’s largest oil and gas companies are deploying advanced analytics solutions, like Seeq, to provide these automated and self-service analytics capabilities to their SMEs. By installing these types of solutions, teams can immediately alleviate the challenges of live data connectivity because the software automatically connects to and aggregates data from many types of disparate sources into a single platform. All the while, information integrity is kept intact because the analytics application does not modify any source data in their original repositories. Automated data cleansing and contextualisation significantly reduces the time spent preparing data for analysis, leading to quicker insights.

Without data access and preparation barriers to worry about, SMEs can leverage purpose-built, point-and-click tools for descriptive, diagnostic, predictive, and prescriptive analytics to improve performance based on reliable insights. Advanced analytics solutions incorporate visualisation into the analysis workflow, empowering SMEs to see the impact of their analyses in near-realtime, pinpoint missteps, identify and share successes, and iterate and innovate more quickly than before.

These innovative solutions empower SMEs to identify unique periods of interest in their data, characterised by qualities known as conditions, to determine when equipment is exhibiting abnormal operational behaviour. These conditions can be established by superimposing multiple operational parameters, then defining time periods of interest by finding rapid process value changes, specific signals, or trends that exceed static operating limits (Figure 2).

In the point-and-click environment, SMEs can easily configure the process in machine learning capable models without assistance from IT resources, almost regardless of their coding-literacy level. Once unique conditions are defined for a single asset, advanced analytics solutions empower teams to seamlessly scale a single configuration across a fleet of similar equipment for near-real-time monitoring.

Automating greenhouse gas reporting

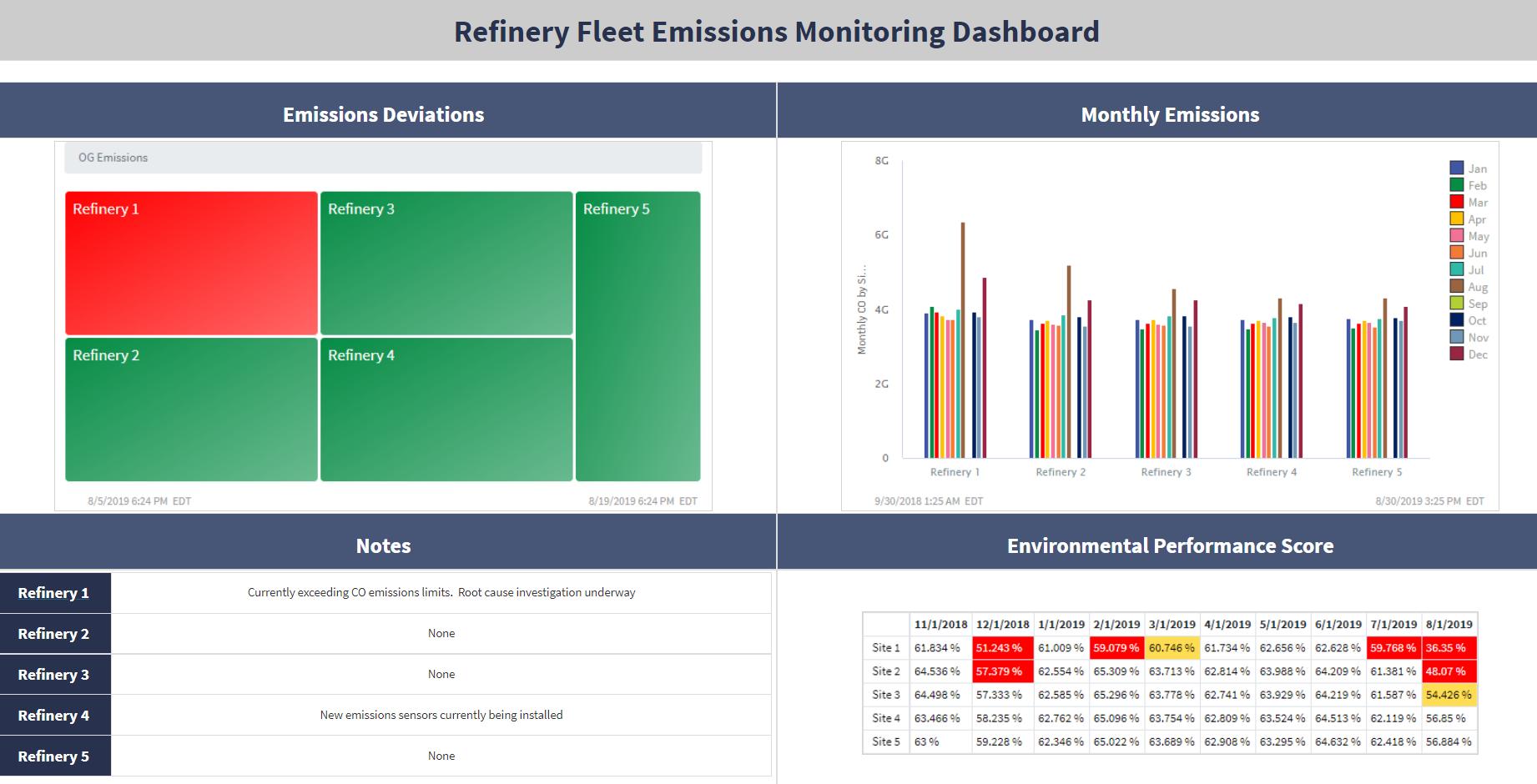

When Chevron sought to automate their regulatory compliance reporting for

Figure 1. A CrowdFlower survey revealed data scientists and other operations personnel spend an inordinate amount of time preparing data for analysis.

Figure 1. A CrowdFlower survey revealed data scientists and other operations personnel spend an inordinate amount of time preparing data for analysis.

a Qapqa brand

• Increase productivity

• Increase quality

• Lower repair rates

• High level of support

Together, we create the most distinctive and integrated welding solutions for the construction of reliable and sustainable pipelines.

Whether it’s oil, gas, or any other fluid, we are here to ensure reliability and make projects run smoothly. Quality is top priority, we settle for nothing less than perfection.

No matter location, challenges, or circumstances, Qapqa is your go-to partner for exceptional welding solutions. From remote deserts to high altitude environments, we deliver our expertise to every corner of the globe.

Qapqa. Joining solutions.

greenhouse gas (GHG) emissions across their refineries, they turned to advanced analytics to automate this workflow. By leveraging Seeq, the company introduced the ability to access data from refinery historians and apply calculations and contextualisation for quarterly regulatory emissions reporting.

Additionally, extensibility features within the solution empowered the team’s SMEs to create a custom solution for extracting final emissions data and formatting it for direct ingestion into their corporate GHG reporting software (Figure 3). With automatic calculations and real-time updates that incorporate the latest data, Chevron reduced analysis time from two or three days to only a few hours. Most notably, the up-to-date and readily available emissions performance information enabled the company to take a proactive approach to emissions identification and mitigation, resulting in prevention in some instances, rather than reporting events long after the fact.

Automating exception-based surveillance

Marathon Oil, where teams are tasked with monitoring nearly 4000 wells, recently eased this substantial task by implementing and scaling Seeq across the enterprise. The company achieved this by automating workflows to create alert types, reducing the time required for this task from months to hours. These intelligent alerts are used to drive and prioritise maintenance tasks and work orders for personnel in the field, and they empower operational teams to reduce unplanned outages, ultimately increasing production and profitability.

The company improved scalability by using Seeq to connect production data from across all its wells. The company has over 50 employees using the solution with 170 Seeq Workbench analyses. It generates 1500 tasks, and

over 1500 notifications a month. What was being manually identified in the past is now automatically generated, increasing production capacity by proactively identifying issues to increase uptime.2

Marathon Oil achieved this scale by placing curated technology in the hands of its personnel, empowering them with notifications and insights to operate efficiently.

Embracing advanced analytics applications for digital maturation

For pipeline operators, leveraging advanced analytics solutions like Seeq is critical in today’s information landscape to provide staff with the tools they need to contextualise, analyse, and make the right decisions. Powerful technology by itself does not ensure success, but software tools with wide-reaching connectivity, automated data cleansing, cloud access, capable algorithms, and intuitive collaboration means cannot be overlooked.

Advanced analytics solutions designed to scale highvalue use cases across assets can increase the rate of digital maturation in an organisation, but even these software solutions require strong foundations of data storage and accessibility. Digital transformation is an organisation-wide initiative, and placing analytics tools in the hands of all personnel can significantly increase adoption. By empowering employees with these capabilities, companies can count on advances in profitability, sustainability, and safety as process optimisation and insight sharing spreads.

References

1. CrowdFlower Data Science Report 2016 (https://visit.figure-eight.com/rs/416ZBE-142/images/CrowdFlower_DataScienceReport_2016.pdf )

2. https://aws.amazon.com/partners/success/marathon-oil-seeq/

The non-destructive test (NDT) service market for pipelines is at a crossroads, with an inevitable need for transformation looming on the horizon. On the one hand, the market is poised for unprecedented growth. According to Fortune Business Insights, the global NDT market size is expected to reach US$16.66 billion by 2029, with a CAGR of 13.66% during the forecast period. Demand has been galvanised by governments around the world, tightening safety and environmental regulations.

In addition, an unprecedentedly high level of ageing infrastructure will require massive

investments and monitoring to maintain operational capacities. For example, the American Society of Civil Engineers (ASCE) Report Card for America’s Infrastructure gave a blistering Cfor the US’ infrastructure. While the score was bumped up from the D to D+ range for over 20 years, it still shows general signs of massive deterioration, which increase the likelihood of functional and performance deficiencies, and increase vulnerability to risk.

ASCE estimates that investments of US$281 billion/yr are needed to reverse the impact of infrastructure failure. If investments are not made, the report indicates it will cost America US$10 trillion in GDP by 2039. The need for NDT services is definitely set to skyrocket.

However, challenges are rampant despite robust demand for NDT services, whether in-house or by third-party businesses. The main hurdle? Workplace demographics. Based on statistics by Zippia, a major career site, the average age of NDT technicians, which comprise 66% of the

workforce, is 45 years. As many NDT managers know, these professionals are prone to retire early. What’s more, only 12% of NDT technicians are under the age of 30. With unemployment rates in the profession hovering at 2 - 3%, the ripple effects of a crippling labour shortage become blatantly clear.

Indeed, a perfect storm is brewing for the NDT industry, compromising demand fulfilment.

Modern challenges require modern technology

To successfully weather this storm, NDT companies and teams must adopt a proactive approach to their service

management. This includes investing in training and development programmes to attract and retain skilled workers, and implementing new technologies to improve NDT efficiency and boost service capacity.

The World Corrosion Organisation claims that infrastructure by corrosion damage alone is estimated to cost US$2.2 trillion worldwide each year. The organisation says that between 20% and 25% of corrosion costs could be mitigated by using new technologies and innovative maintenance programmes. In order words, investing in new technologies and developing a proactive maintenance programme could not only help reduce the impact of the aforementioned challenges but also generate a high return on investment (ROI). One such technology investment is through better instrumentation, such as 3D scanning, to elevate and accelerate decision-making.

In the past, NDT businesses were often hesitant to adopt new technologies and make investments to implement new inspection methodologies. But with the new demand and technician shortage imperatives, 3D scanners can unlock impressive operational opportunities that counter-balance the investment.

Scanner benefits

For one, metrology-grade 3D scanners, like Creaform’s HandySCAN 3D or Go!SCAN 3D, are user-independent. That means that the 3D scanner can generate repeatable

Figure 1. Surface analysis of pittings cluster on a cylindrical transportation pipeline.

Figure 1. Surface analysis of pittings cluster on a cylindrical transportation pipeline.

and accurate results of up to 0.0009 in., regardless of the operator’s skill level or experience. 3D scanning is the most accurate technique to measure surface damage, which gives asset owners peace of mind knowing they are making decisions based on unequalled inspection accuracy.

3D scanning is also a simple technique. It requires no lengthy training or extensive certification process. Offering short learning curves and quick set up times, 3D scanners can easily be deployed inside any organisation. Besides their simplicity, 3D scanners’ portability enables inspection teams to transport them to any site and reach constrained areas that were either too cumbersome or dangerous to attain with conventional methods.

Some 80 times faster than the traditional pit gauge method, 3D scanners drastically improve the productivity of NDT teams and avoid unnecessary infrastructure downtimes, staving off costs and ensuring asset owners preserve their service line agreements.

The future of 3D scanning NDT software

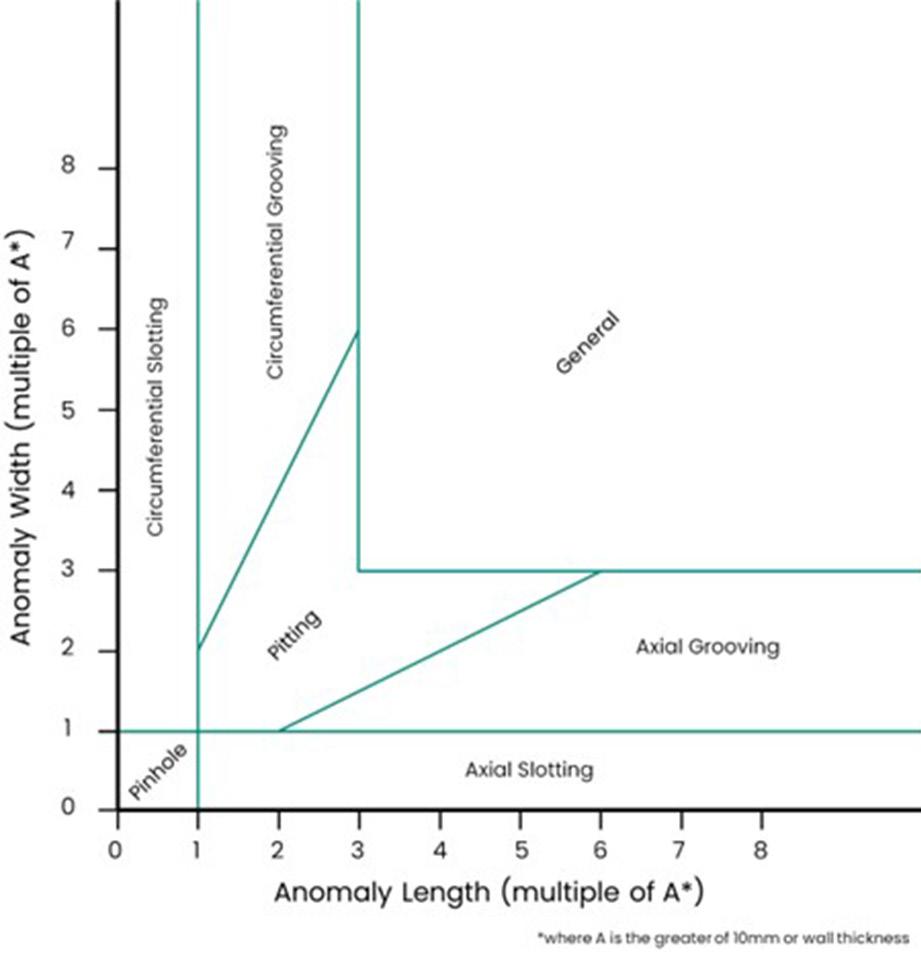

To help inspection teams address market and labour challenges, Creaform has developed a 3D scanning software platform, VXintegrity, based on Pipecheck software and designed specifically for surface damage assessments conducted by NDT teams that cater to the pipeline industry (Figure 1).

Creaform 3D scanners bundled with VXintegrity offer metrology-grade accuracy, traceable data over time and human-independent results that eliminate measurement variations and ambiguity in the interpretation of inspection data.

VXintegrity features several software modules that enable inspection teams to dive deeper into their assessments. The Pipeline Inspection module, formerly known as Creaform’s Pipecheck software, has become the industry reference for assessing mechanical damage on pipelines. Over the years, by integrating automatic defect pattern recognition, interaction parameter and ASME B31.G pass or fail criteria, Pipecheck has greatly reduced the latency time between digging a pipe and re-burying it because inspectors can generate reports onsite. This massive increase in productivity has generated millions of savings for the pipeline owner.

The surface damage module provides users with tools to analyse absolute measurements of thickness loss, dents,

Figure 3. Damage monitoring represented on different industrial components being subject to in service damage and wear.

Figure 3. Damage monitoring represented on different industrial components being subject to in service damage and wear.

gouges, and corrosion on pipeline and pipeline components of any type of geometry (Figure 2). VXintegrity now offers new software capabilities to analyse mechanical damage, such as dent and corrosion, on any type of surface. In fact, accurately measuring damage on complex geometries –without any errors – is a game changer. Curve geometries and others, such as elbows, valves, T-joints, nozzles, and reducers, can now be easily assessed with the same confidence level as the rest of the pipeline.

Ireland-based IPEC Inspection Ltd carried out a major commissioning project by replacing pit gauges and UT sets with a Creaform Go!SCAN Spark 3D scanner and integrated Pipecheck software – and saved over two days of inspection work.

While pent-up NDT demand and lack of skill labour show no signs of abating any time soon, NDT service companies can access innovative technologies to ease the pressure. Solutions like 3D scanners with integrated inspection software contribute to keeping up the pace with projects and honouring contracts with a smaller workforce.

High voltage Holiday Detector

Detects holidays, pinholes, and other discontinuities using continuous DC

t i r

o l t

r a n g e f r o m 0 5 t o 3 0 k

n

Finally, with the introduction of the damage monitoring module, Creaform developed tools that allow access to all the information required to perform repairs (Figure 3). This new module could be compared to a basic metrology tool kit that allows them to digitally measure difficult geometries, including ovality deformation, radius bending of a pipe section, wear on a flange surface, and more (Figure 4). Moreover, this module includes all the features needed to quickly compare a digital asset to a CAD model, a perfect geometry, or even a previously digitalised damaged surface. Inspectors can then determine corrosion rates and pre-emptively identify the right repair dates. This module definitely maximises the information and documentation value for predictive and preventative maintenance.

p t o 1 6 h o u r s o f b a t t e r y l i f e p o w

r f

t

r i

s f i t n e a t l y w i t h i n t h e

o m p a c t w a n d h a n d l e e l i m i n a t i n g t h e n e e d f o r a s e p a r a t e b a t t e r y b o x n B u i l t - i n C e r t i f i e d Vo l t m e t e r a n d Vo l t a g e C a l c u l a t o r f e a t u r e n I n d u s t r y s t a n d a r d c o n n e c t o r s a n d a d a p t o r s p r o v i d e c o m p a t i b i l i t y w i t h n e a r l y a l l e x i s t i n g e l e c t r o d e s

VXintegrity gives the tools

NDT companies need to generate reports for asset owners as well as archive the wealth of 3D measurement data in the event audits are carried out or to prove regulatory compliance.

Proven in the field

Many ahead-of-the-curve NDT service companies are already leveraging the potential of 3D scanning and inspection software.

Hydro Safety Engineering, based in Europe, assessed the degree of wear of an almost 100 year old pressure pipeline with a deep entry into the penstock full of water and mud.

Tilt Inspection & Consulting, a major NDT business in Western Canada, elevated the quality of the reports they sent to clients and cut onsite inspection times, which contributed to impressive cost-savings.

No shoulder bag required!

Also available with Pulsed DC

High voltage Holiday Detector

Stick-type with Pulsed DC

Wand-style with Continuous DC

or the last several years, North America’s energy industry has been experiencing unprecedented upheaval. Gyrations in demand due to COVID-19, deadlines for net-zero carbon emissions, environmental activism and the side-effects of the Ukraine war have all created tremendous economic and logistical complications that affect every aspect of the sector, including pipelines.

Canada

Canada is blessed with an abundance of hydrocarbons; both conventional and unconventional. While most attention has been focused on production of gas from shales in the US, the Montney formation in northeast British Columbia (B.C.) has been flying under the radar. The extensive shale contains an estimated 450 trillion ft3 of gas and currently produces 5.8 billion ft3/d. Producers have proposed processing capacity to eventually double production to 11.5 billion ft3/d. Several pipeline systems are being expanded to meet the expected increase. Enbridge has earmarked CAN$1.9 billion to expand its Westcoast natural gas system that services B.C. and Alberta. In November 2022, it announced an open season to its T-North segment, which runs from Fort Nelson in northern B.C. to southern and eastern consumers. Sufficient consumer interest could result in an additional 500 million ft3/d of capacity.

Construction on TC Energy’s Coastal GasLink pipeline is nearing completion. The 670 km line runs from northeastern B.C. to the Pacific port of Kitimat, where it will supply up to 2.1 billion ft3/d of gas to Shell’s LNG Canada plant (currently under construction). The pipeline, which is scheduled to come online in 2023, has been plagued by fractious protests from First Nations factions opposed to the ROW crossing ancestral

lands. Cost overruns due to labour shortages and logistics related to COVID-19 have also caused the budget to grow from an original CAN$6.6 billion to over CAN$14.5 billion. Despite the challenges, TC Energy is in discussions with Shell in regards to Phase 2 of the latter’s LNG project that would require increasing capacity to 5 billion ft3/d.

In late 2022, Enbridge launched a successful open season on an expansion programme on the T-South portion of its pipeline system in B.C. The system runs from the Ft. St. John region in northeast B.C. to the US border south of Vancouver. The Sunrise Expansion Program would increase export capacity by 300 million ft3/d through looping and additional compression. Pending FID, the expansion is being targeted for 2028.

Canada’s total crude production exceeds 5 million bpd. The oilsands of Alberta is the largest single source, with 3.3 million bpd, and output is expected to rise to 3.6 million bpd over the next decade. Canada exports approximately 4 million bpd to the US, which is expected to rise to 4.2 - 4.4 million bpd by 2026.

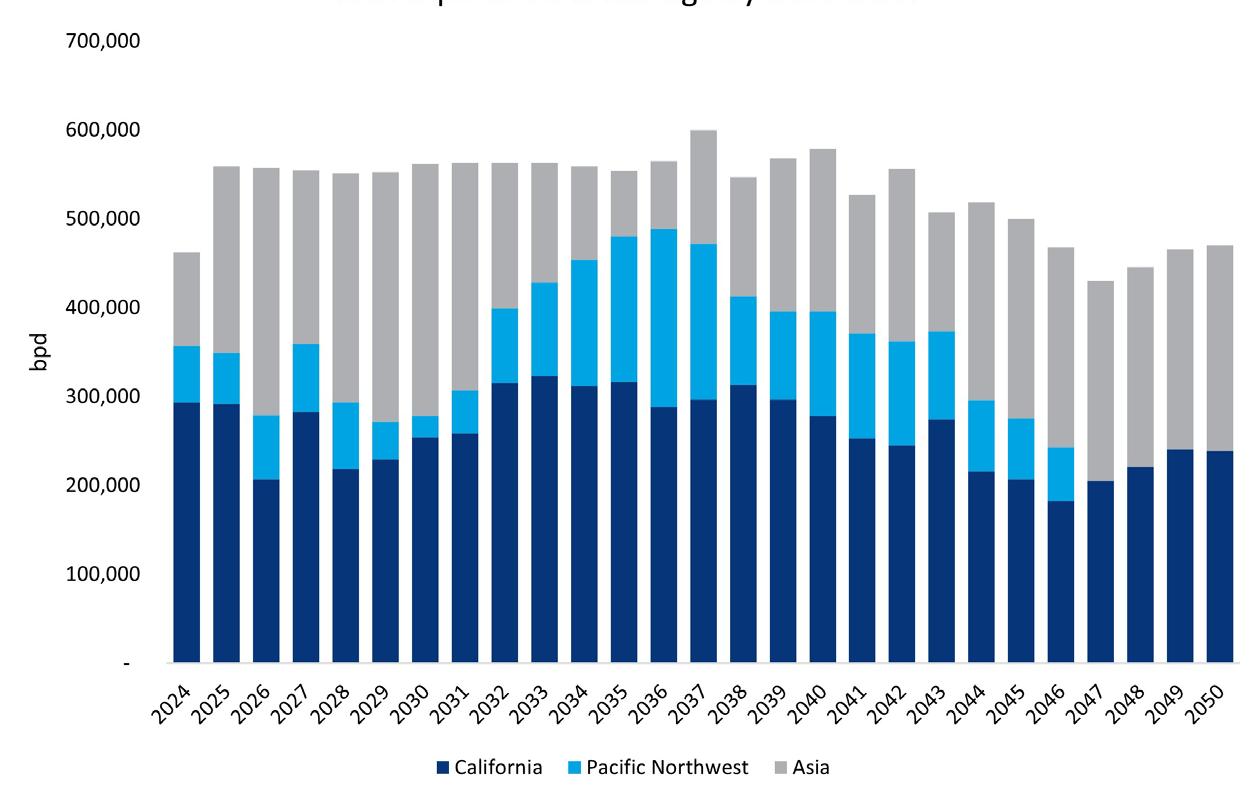

Because its export markets are limited, Canadian crude is often sold at significant discount when US refineries go offline or demand slows. In order to develop alternative outlets, Kinder Morgan initiated an expansion of the Trans Mountain line (TMX), which carries 300 000 bpd from Alberta to the port of Burnaby, B.C., near Vancouver. The TMX has also confronted significant environmental opposition, as well as COVID-19 related delays and severe flooding of the ROW. As a result, the cost has increased from an original estimate of CAN$12.6 billion, to over CAN$21 billion. Once the expansion becomes operational in 2024, it will deliver up to 890 000 bpd to its expanded Burnaby terminal. Ironically, the primary expected destination is no longer Asia; refiners in that region are gorging on cheap Russian oil, and the likely buyers for TMX output will be in Washington State, Oregon and California.

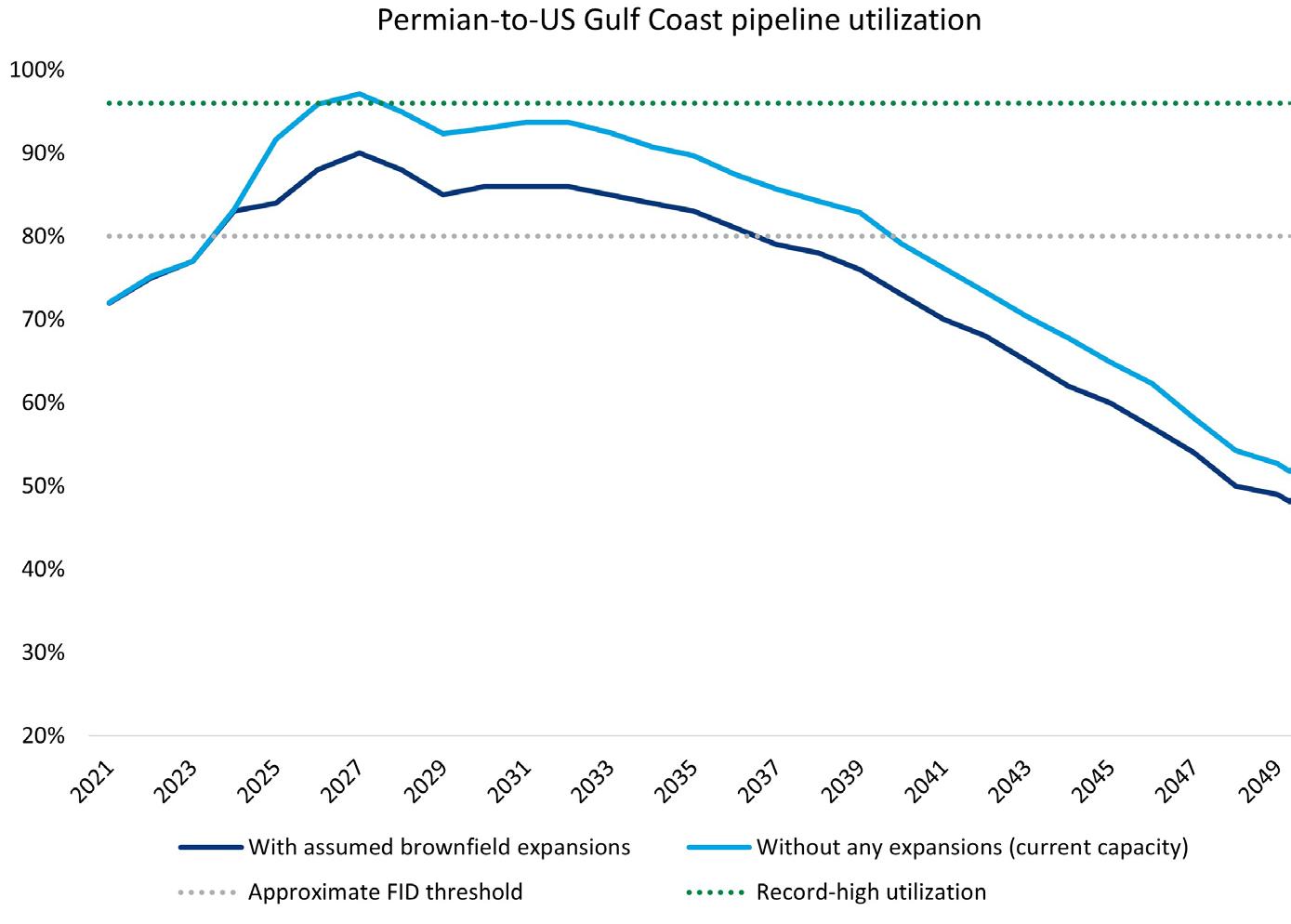

USA

In the US, pipeline growth is being driven primarily by the push to export gas and crude from the US Gulf Coast (USGC) to jurisdictions around the world. According to the Energy Information Administration (EIA), USGC (PADD 3) exports averaged 2.48 million bpd in 2021; by late 2022, that number had grown to over 4 million bpd, with the majority of the increase coming from the Permian basin and Western Canada.

Increasingly, midstream efforts are focusing on export facilities. In May, 2023, Enbridge announced a binding open season for the Flanagan South pipeline expansion. The 720 000 bpd pipeline runs from Illinois to Cushing, OK, and the expansion would add another 110 000 bpd capacity for Western Canada and Bakken crude. Flanagan South pipeline connects to the Houston region via Enbridge’s 950 000 bpd Seaway Pipeline. Enbridge recently announced that it was proceeding with the Enbridge Houston Oil Terminal (EHOT) at the southern end of its Seaway Pipeline. The first phase of the new facility will have up to 2.5 million bbls of crude storage, with the potential to expand to 15 million bbls.

Enbridge is also beefing up its export facilities in Corpus Christi, Texas. In 2022, the company assumed operatorship of the Gray Oak pipeline, which delivers 900 000 bpd from the

Permian Basin to Enbridge’s Ingleside Energy Center (EIEC) in Corpus Christi. Enbridge and Plains also purchased the majority interest in the Cactus II pipeline, which delivers 670 000 bpd from West Texas to EIEC. EIEC is the largest crude oil storage and export terminal by volume in the US, with approximately 15.3 million bbls storage capacity. Enbridge is adding almost 2 million bbls of new storage in the next year.

After suffering decreases during COVID-19, US gas production is once again climbing; the EIA expects dry gas production to exceed 100 billion ft3/d in 2023. Much of that has been within the Permian basin. Associated gas in the Permian has risen from pre-pandemic level of 17.4 billion ft3/d in 2019 to the current level of 22.5 billion ft3/d.

US demand has been slowly decreasing, and now stands at 87 billion ft3/d. Part of the 13 billion ft3/d gap is slated for export to Mexico. Kinder Morgan’s new 2.1 billion ft3/d Permian Highway Pipeline (PHP), is a 430 mile pipeline from West Texas to the Gulf Coast, where it has additional connections to Mexico’s interstate pipeline network.

Gas is also being exported via LNG. The EIA estimates that LNG exports will average 12 billion f3/d in 2023, up from 10.65 billion ft3/d in 2022. An estimated 100 million tpy of new projects, representing over 14 billion ft3/d, are on the planning boards. Several expansions and new pipelines are planned to enter service in the next several years. WhiteWater and partners expect the Matterhorn Express to enter service in late 2024. The 490 mile long line will deliver up to 2.5 billion ft3/d from the Waha Hub in West Texas to Katy, Texas, near Houston. The company is also expanding its Whistler Pipeline by 500 million ft3/d, to 2.5 billion ft3/d. In June, 2022, Williams reached an FID to build the Louisiana Energy Gateway, a 1.8 billion ft3/d greenfield project designed to deliver gas from the Haynesville basin to LNG projects on the Gulf Coast. The US$1.5 billion pipeline is expected to enter service in late 2024.

NGLs

US production of natural gas liquids (NGLs), which includes ethane, propane and butane, has grown from 1.8 million bpd in 2008 to 6 million bpd in 2023. The growth has been largely driven by shale production, as well as greater gas-to-oil ratios. Gathering and processing facilities have grown in tandem, resulting in thousands of miles of dedicated NGL pipelines. Targa Resources is a major NGL player. It owns and operates over 14 000 miles of lines in the Permian Basin region, as well as 33 processing plants with a total capacity of 7 billion ft3/d. It operates the 550 000 bpd Grand Prix line that ships product to the Mt Belvieu NGL hub in Texas. Targa operates the Galena Park Marine Terminal adjacent to Mt. Belvieu. The facility, with a loading capacity of 450 000 bpd, can handle very large gas carriers. In late 2022, Targa announced it was building the 400 000 bpd Daytona line, to be completed by 2024, raising system capacity to almost 1 million bpd.

Legal and regulatory problems

Environmental activists intent on eliminating oil and gas usage find pipelines a tempting legal target, as do populist politicians. Enbridge’s Line 5 transports 540 000 bpd from Canada (and North Dakota) through Michigan to Ontario and

INNOVATIVE AND CUSTOMIZED SOLUTIONS FOR EVERY CHALLENGE since 1958

WIDTH 2550 MM: STANDARD EUROPEAN TRANSPORTATION LIMITS, WITH COMPLETE ASSEMBLED MACHINE

HYDROSTATIC, VARIABLE SPEED ESCALATOR

TWO-SIDE BELT WITH HYDRAULICALLY-CONTROLLED EXTENSION